Table of Contents

Introduction to Hugo Bank Pakistan

With the experience that the current leadership has brought to Hugo Bank, this is poised to join the ranks of new generation innovative banking system in the financial market in Pakistan. Founded as a digital bank aspirant with the in-principle approval of the State Bank of Pakistan, The Bank promises to revolutionize the Pakistani’s approach to financial service providers.

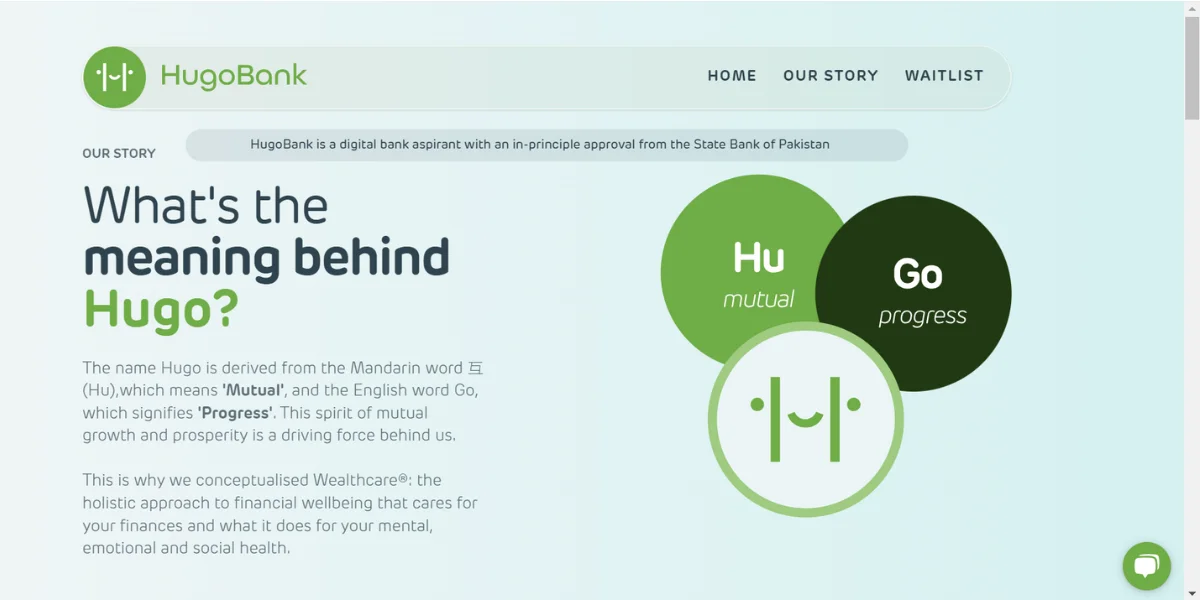

HugoBank is more than just a bank – it’s a digital bank with big ambitions. Approved by the State Bank of Pakistan, Bank is on a mission to change how Pakistanis think about banking. The name “Hugo” comes from the Mandarin word 互 (Hu), meaning ‘Mutual,’ and the English word ‘Go,’ symbolizing progress. This perfectly captures what we’re about – mutual growth and helping people move forward.

The Vision Behind Hugo Bank

The objective of Hugo Bank Pakistan is crystal clear and exceptionally lofty: to democratize banking in the country and provide “Banking for All.” With a population of around 220 million people, more than half of whom are underserved by traditional financial institutions, Bank aims to bridge this significant gap. By utilizing cutting-edge technology and user-friendly solutions, the bank is dedicated to making financial services accessible to everyone, regardless of their socio-economic background.

At the core of this mission is the belief that banking should be simple and inclusive. By focusing on innovation, Hugo Bank Pakistan seeks to remove the barriers that currently prevent millions from accessing essential financial services. This vision is supported by the forward-thinking leadership of the Bank owner, who is committed to driving the bank’s mission of financial inclusion across the country.

For those interested in joining the movement towards democratizing banking, the Bank’s careers offer exciting opportunities to be part of a groundbreaking initiative. The bank is constantly on the lookout for passionate individuals who want to contribute to this mission, with roles available across various departments. The Bank office address is easily accessible, reflecting its open and inclusive approach to both its customers and employees.

As Hugo Bank Pakistan continues to grow, it remains dedicated to closing the gap in financial services and ensuring that everyone, from urban centers to remote areas, has access to modern, efficient banking. With a strong leadership team and a clear goal, Hugo Bank is set to revolutionize how banking is done in Pakistan, ensuring that “Banking for All” becomes a reality.

Commitment to Financial Inclusion

- Increasing Pakistan’s bank account penetration rate from 16.29% to over 80% within five years

- Opening 34 million new accounts by 2027

- Driving financial education and literacy across the nation

- Offering accessible and affordable services

The Power Team Behind Hugo

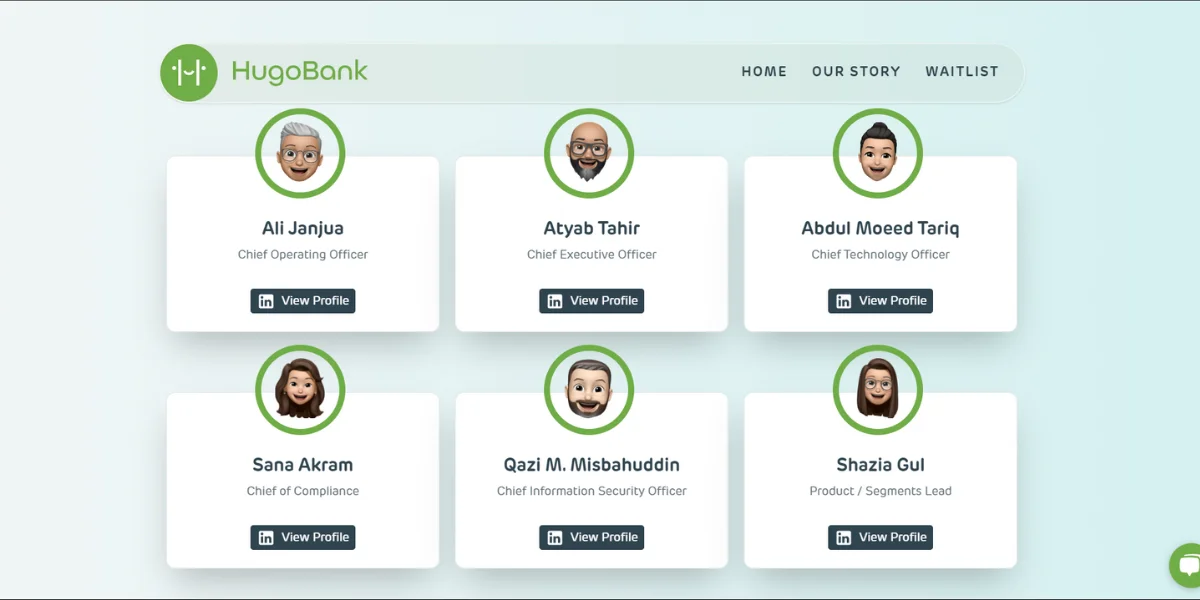

At the helm of Hugo Bank is a team of visionaries and industry experts:

Hugo Bank CEO and Leadership

- Atyab Tahir (Chief Executive Officer): With over 20 years of experience in fintech and digital financial services, Atyab brings a wealth of knowledge to Hugo Bank.

- Ali Janjua (Chief Operating Officer): Ali’s expertise is crucial for shaping the bank’s customer service protocols and internal efficiencies.

- Abdul Moeed Tariq (Chief Technology Officer): Abdul Moeed’s tech prowess is vital in developing Hugo Bank’s secure and innovative digital banking platform.

- Sana Akram (Chief of Compliance): Sana ensures that Hugo Bank meets all regulatory standards.

- Qazi M. Misbahuddin (Chief Information Security Officer): Qazi’s oversight guarantees the security of customer data and transactions.

- Shazia Gul (Product/Segments Lead): Shazia’s leadership helps tailor Hugo Bank’s offerings to meet diverse customer needs.

Hugo Bank Owner and Consortium

Hugo Bank is backed by a powerful consortium that brings together international expertise and deep local knowledge:

- Atlas Consolidated (Singapore)

- The Getz Group (Singapore)

- Muller & Phipps (Pakistan)

The Impact on Pakistan’s Financial Landscape

Bank’s entry into the market is expected to have far-reaching effects on Pakistan’s financial ecosystem:

- Increased financial inclusion: By targeting the 53% of Pakistan’s population that is currently unbanked, HugoBank aims to bring millions into the formal financial system.

- Economic growth: Increased access to financial services can contribute significantly to Pakistan’s GDP growth.

- Empowering SMEs: By offering tailored solutions for small and medium enterprises, HugoBank can help drive economic activity and job creation.

- Promoting financial literacy: Through its commitment to financial education, HugoBank can help raise overall financial awareness in the country.

- Technological advancement: As a digital-first bank, HugoBank will push the boundaries of financial technology in Pakistan.

Recent Banks Approved by State Bank OF Pakistan

Challenges and Opportunities

While the road ahead is promising, HugoBank faces several challenges:

- Regulatory hurdles: Navigating the complex regulatory environment in Pakistan’s financial sector.

- Digital literacy: Addressing varying levels of digital literacy among potential customers.

- Infrastructure limitations: Overcoming potential issues related to internet connectivity and smartphone penetration.

- Competition: Standing out in an increasingly competitive digital banking landscape.

However, these challenges also present opportunities:

- First-mover advantage: As one of the early entrants in Pakistan’s digital banking space, Bank has the opportunity to set industry standards.

- Untapped market: With a large unbanked population, there’s significant potential for growth.

- Technological innovation: The challenges provide a platform for Hugo’s Bank to innovate and create unique solutions tailored to the Pakistani market.

Innovative Features and Services

Hugo Bank is set to offer a range of digital banking services designed to meet the needs of Pakistan’s tech-savvy population, including:

- Lightning-fast online account opening

- Secure fund transfers and payments

- Convenient bill payments

- Customer credit products

- Peer-to-peer payments

- Automated savings plans

- Personalized financial management tools

- 24/7 access to banking services

Bank App Early Access Signup!

Bank Location and Address

While the exact Bank office address is yet to be announced, it’s expected to be centrally located in Karachi, Pakistan’s financial hub. As Hugo Bank’s operations expand, multiple Hugo Bank locations may be established across Pakistan to better serve customers.

Hugo Bank’s Karachi Address

The specific Hugo Bank Karachi address will be revealed closer to the launch date. Stay tuned to the official Bank’s website for updates on office locations and customer service centers.

Morover this is the current expected location in Karachi for hugo bank.

3rd Floor, MA Tabba Foundation Building, Gizri Rd, Block 9 Clifton, Karachi, Pakistan 75600.

Careers

Join the Digital Banking Revolution!

For those interested in being part of Pakistan’s digital banking future, Bank careers offer exciting opportunities. The bank is actively recruiting talent across various departments, from technology and finance to customer service and compliance.

Explore Job Opportunities

Visit the Hugo Bank careers page on their official website to view current openings and application procedures.

The Hugo Bank Logo

A Symbol of Innovation!

The Hugo Bank’s logo, while not yet publicly revealed, is expected to embody the bank’s commitment to innovation, trust, and financial inclusion. Keep an eye out for the unveiling of this new symbol in Pakistan’s banking landscape.

Podcast with Atyab Tahir (CEO)

Conclusion

The Future of Banking with Hugo Bank!

Hugo Bank’s stands at the cusp of a digital banking revolution in Pakistan. With its strong leadership, innovative approach, and commitment to financial inclusion, it has the potential to significantly impact Pakistan’s financial ecosystem. As Bank prepares for its launch, it’s poised to reshape the financial future of millions of Pakistanis.

For the latest updates on Hugo Bank’s launch, services, and locations, visit their official website or follow their social media channels.

References

- HugoBank Official Website. (2024). Retrieved from https://www.hugobank.com.pk

- State Bank of Pakistan. (2023). Digital Banking Framework. Retrieved from [SBP website]

- PRNewswire. (2023, March 27). HugoBank Appoints Atyab Tahir as CEO to Build a Digital Bank in Pakistan. Retrieved from https://www.prnewswire.com/apac/news-releases/hugobank-appoints-atyab-tahir-as-ceo-to-build-a-digital-bank-in-pakistan-301780717.html

- The Business Times. (2023, January 17). Hugosave’s parent to set up digital bank in Pakistan. Retrieved from https://www.businesstimes.com.sg/startups-tech/hugosaves-parent-set-digital-bank-pakistan

- Fintech Intel. (2023, January 23). HugoBank is granted digital banking licence in Pakistan. Retrieved from https://fintech-intel.com/banktech/hugobank-is-granted-digital-banking-licence-in-pakistan/

- The Nation. (2024, July 7). The role of banking in the digitalisation of Pakistan’s economy. Retrieved from https://www.nation.com.pk/07-Jul-2024/the-role-of-banking-in-the-digitalisation-of-pakistan-s-economy

- TrustDecision. (2024, March 4). 2024’s Top Banks in Pakistan Transforming the Digital Landscape. Retrieved from https://trustdecision.com/resources/blog/2024-top-banks-pakistan-transforming-digital-landscape

- CB Insights. (n.d.). Top SadaPay Alternatives, Competitors. Retrieved from https://www.cbinsights.com/company/sadapay/alternatives-competitors

1 comment