Table of Contents

What Are Mutual Funds in Pakistan?

Mutual funds in Pakistan are collective investment schemes where money from multiple investors is pooled and managed by professional fund managers to invest in a diversified portfolio of assets such as stocks, bonds, and other securities. By allowing a diverse group of investors—ranging from small-scale to high-net-worth individuals—to access professionally managed portfolios, mutual funds have gained popularity as a relatively safer investment option.

Mutual funds are investment plans sponsored by shareholders, where various properties are bought and sold under professional management. In Pakistan, these funds pool capital from multiple investors to provide funding in securities like stocks and bonds. This allows individual investors to benefit from professional management and diversification with relatively small investments.

In Pakistan, the mutual fund industry is regulated by the Securities and Exchange Commission of Pakistan (SECP), which ensures transparency and compliance with industry standards. This regulatory oversight instills a sense of security and reliability, making mutual funds an attractive investment avenue.

Best Mutual Funds in Pakistan

When considering the best mutual funds in Pakistan, several factors such as performance history, management fees, and investment strategy come into play. Here are some notable options:

| Fund Name | Type | 1-Year Return (%) | Management Fee (%) |

|---|---|---|---|

| Al Meezan Mutual Fund | Equity | 15.56 | 2.5 |

| HBL Money Market Fund | Money Market | 16.4 | 1 |

| UBL Stock Advantage Fund | Equity | 10.4 | 3 |

| ABL Islamic Income Fund | Islamic Income | 12.27 | 1 |

These funds have shown competitive returns and are managed by reputable institutions.

Mutual Funds Profit Rates in Pakistan

The profitability of mutual funds largely depends on stock market conditions and managerial decisions. As of October 2024, notable profit rates include:

- Al Meezan Mutual Fund: Annualized return of approximately 15.56%.

- HBL Money Market Fund: Average return of about 16.4%.

- UBL Stock Advantage Fund: Return of around 10.4%.

These performance rates reflect the past year and are subject to change based on market dynamics.

Why Invest in Mutual Funds?

Investing in mutual funds offers several advantages, such as:

- Diversification: Mutual funds spread investments across various assets, minimizing risk compared to putting all funds in one stock or asset class.

- Professional Management: Investors benefit from the expertise of fund managers who make informed decisions.

- Low Entry Barrier: Mutual funds provide opportunities for individuals with small amounts of capital to invest in a broader market.

- Liquidity: Unlike other investment options, mutual funds offer relatively easy entry and exit points.

- Variety: There are several types of mutual funds available to suit different risk appetites and investment goals.

Types of Mutual Funds in Pakistan

Mutual funds in Pakistan can be broadly categorized based on the asset classes and investment strategies they follow:

1. Equity Funds

- Primarily invest in stocks and equities.

- Suitable for investors seeking high returns and willing to accept higher risk.

2. Income Funds

- Invest in fixed-income securities such as government bonds and corporate debt.

- Provide stable returns and are ideal for conservative investors.

3. Money Market Funds

- Invest in short-term debt instruments like Treasury Bills.

- Offer high liquidity and are considered low-risk.

4. Balanced Funds

- Combine equity and fixed-income investments to balance risk and return.

- Suitable for moderate risk-takers.

5. Islamic/Shariah-Compliant Funds

- Follow Islamic principles by avoiding investments in companies dealing in prohibited (haram) activities.

- These funds are particularly appealing to investors seeking religiously compliant options.

6. Sector-Specific Funds

- Focus on specific sectors like technology, healthcare, or energy.

- Provide opportunities for high growth in niche markets but carry higher risk.

How to Invest in Mutual Funds in Pakistan

- Identify Your Investment Goals: Determine your financial objectives, risk tolerance, and time frame.

- Choose a Fund Management Company: Select an Asset Management Company (AMC) offering various mutual funds.

- Select a Mutual Fund Type: Choose from equity, income, money market, or Islamic funds based on your risk preference.

- Fill Out the Application Form: Visit the AMC’s office or apply online.

- Submit KYC Documents: Complete the Know Your Customer (KYC) process with valid documents.

- Make Your Investment: Use bank transfer, cheque, or cash deposit.

- Monitor Your Investment: Regularly review the fund’s performance.

Best Mutual Funds in Pakistan

- Meezan Islamic Fund (MIF): Popular Islamic mutual fund offering good returns.

- UBL Stock Advantage Fund (SAF): Suitable for equity investors seeking capital gains.

- ABL Income Fund: Provides stable income with low risk.

- Faysal Money Market Fund: Low-risk fund with high liquidity and assured returns.

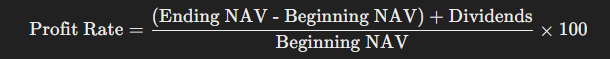

Calculating Mutual Fund Profit Rates in Pakistan

To calculate mutual fund profit rates in Pakistan, consider the following factors:

- Fund Type: Equity funds generally provide higher returns (10% to 15%), but with more risk. Income and money market funds offer lower returns (7% to 9%) but are more stable.

- Tips:

- Analyze past performance, the fund manager’s experience, and the current economic situation.

Investment Strategies of Mutual Funds

To maximize returns, consider the following strategies:

- Diversification: Invest across various sectors to mitigate risks.

- Long-Term Holding: Maintain a long-term perspective to ride out market fluctuations.

- Regular Review: Periodically assess fund performance and adjust your portfolio as needed.

Advantages of Investing in Mutual Funds

- Professional Management: Managed by experienced fund managers in consultation with experts.

- Diversification: Reduces risk by spreading investments across different securities.

- Liquidity: Most mutual funds offer quick redemption of shares.

- Accessibility: Low minimum investment amounts make it easier for many individuals to invest.

Risks Linked to Mutual Funds

Despite their advantages, mutual funds carry certain risks:

- Market Risk: Investment value may fluctuate due to overall market conditions.

- Management Risk: Poor decision-making by fund managers can lead to subpar performance.

- Liquidity Risk: Some funds may have restrictions on redemptions during certain periods.

Best Islamic Mutual Funds in Pakistan

For investors seeking Shariah-compliant options, several Islamic mutual funds stand out:

| Fund Name | Type | 1-Year Return (%) |

|---|---|---|

| ABL Islamic Income Fund | Income | 12.27 |

| HBL Islamic Stock Fund | Equity | 11.01 |

| Al Baraka Islamic Fund | Mixed | 13.5 |

These funds adhere to Islamic principles while providing competitive returns.

- Meezan Islamic Fund (MIF): A pioneer in the market with a diversified Shariah-compliant portfolio.

- Al Meezan Mutual Fund: Offers a variety of Islamic funds, both aggressive and conservative.

- UBL Al-Ameen Islamic Sovereign Fund: Focuses on low-risk Shariah-compliant government securities.

- HBL Islamic Stock Fund: Invests in Shariah-compliant stocks for high growth potential.

Comparing Conventional and Islamic Mutual Funds in Pakistan

Investment Principles:

- Islamic Funds: Avoid interest-based securities and prohibited industries.

- Conventional Funds: Allow broader investment options.

Risk and Return:

- Conventional Funds: Potentially higher returns due to a wider investment scope.

- Islamic Funds: Slightly lower returns but follow ethical and religious principles.

Popularity:

- Islamic funds are increasingly popular due to the growing demand for Shariah-compliant investments.

Factors to Consider Before Investing in Mutual Funds in Pakistan

- Fund Manager’s Track Record: Evaluate the performance and credibility of the Asset Management Company (AMC) and the fund manager.

- Fund’s Historical Performance: Past performance can indicate consistency, but it does not guarantee future results.

- Expense Ratio: A lower expense ratio means more of your investment is utilized for growth rather than management fees.

- Risk Appetite: Determine your willingness to take risks; money market funds are safer than equity funds, which offer higher potential returns.

Mutual Funds Investment in Pakistan

A Step-by-Step Guide

- Define your financial goals.

- Research and compare different AMCs and their portfolios.

- Select a type of fund (equity, income, or Islamic).

- Complete KYC requirements.

- Make the initial investment.

- Monitor the fund’s performance regularly.

How to Invest in a Mutual Fund in Pakistan

The Right Method

- Match Your Investment Horizon: Align long-term goals with equity funds and short-term goals with income or money market funds.

- Consider the Fund’s Philosophy: Ensure the fund’s investment policy aligns with your overall financial strategy.

- Review Performance Metrics: Assess metrics like alpha, beta, and standard deviation to gauge fund performance.

Mutual Funds Performance

What to Look For

- Net Asset Value (NAV): The market price for each share of the mutual fund.

- Expense Ratio: The percentage of fund assets used for management fees.

- Benchmark Comparison: Analyze how the fund’s performance compares to a relevant benchmark index.

Mutual Funds vs. Stocks

Which is Better in Pakistan?

- Mutual Funds: Ideal for investors seeking diversification without the time or expertise to manage their assets. They offer a professionally managed portfolio.

- Stocks: Suitable for knowledgeable and experienced investors who prefer to independently select and manage their own shares.

Future Outlook for Mutual Funds in Pakistan

The outlook for mutual funds in Pakistan is positive, driven by increasing investor awareness and supportive regulations from the SECP. As more individuals seek diversified and professional investment options, the mutual fund industry is expected to grow significantly in the coming years.

Investing in mutual funds can be a strategic and profitable choice for those looking to systematically grow their wealth. With thorough research and a solid investment strategy, mutual funds can effectively help investors achieve their financial objectives.

References

Here are some key resources and websites that provide detailed information about mutual funds in Pakistan, including different types of funds, how to invest, and comparison tools:

- Sarmaaya.pk: Mutual Funds Comparison

This website offers comprehensive comparisons of various mutual funds in Pakistan, details about different asset management companies (AMCs), and guidelines on how to start investing. It’s a good starting point for both beginners and experienced investors looking for insights into the best performing funds. - Sarmaaya.pk: How to Invest in Mutual Funds

This guide provides step-by-step instructions on how to invest in mutual funds in Pakistan, including selecting an AMC, assessing risk profiles, and understanding the required documents. It also features a detailed process of opening a mutual fund account, either online or through physical branches. - Pakistan Stock Exchange: What is a Mutual Fund

The PSX website explains the fundamentals of mutual funds, how they work, and their types. It also highlights the benefits and drawbacks of investing in these funds and how to choose between open-ended and closed-ended funds based on your investment goals. - JamaPunji: Mutual Fund Types and Investment Guide

This platform, managed by the Securities and Exchange Commission of Pakistan (SECP), provides insights into different mutual fund categories, such as money market funds, balanced funds, Islamic funds, and more. It helps investors understand which type of fund best suits their financial objectives and risk appetite. - Mutual Funds Association of Pakistan (MUFAP)

The MUFAP website is the central directory for all registered mutual funds in Pakistan. It offers detailed information on various open-end and closed-end funds, their NAVs, risk ratings, and fund categories. It’s a reliable source for tracking fund performance and understanding investment opportunities in the local market.

These links should serve as valuable resources for further exploration of mutual funds in Pakistan, whether you’re looking for investment strategies, comparisons, or a deep dive into the specifics of different fund categories.

Conclusion

Mutual funds in Pakistan offer a versatile and accessible investment option for individuals seeking to diversify their portfolios and meet their financial goals. The available funds span various investment classes, from high-growth equity funds to income-generating and Islamic mutual funds. They cater to both novice investors needing professional management and experienced traders looking to mitigate risk.

One of the key advantages of mutual funds is their professional management, which provides diversification and good liquidity. This makes them suitable for those prioritizing the safety of their investments while still pursuing potential returns. With the emergence of top-performing mutual funds and a growing selection of Shariah-compliant options, investors have more choices than ever to align their investments with their financial and ethical preferences.

Mutual funds represent a viable investment option for individuals looking to grow their wealth while benefiting from professional management and diversification strategies. With various options available ranging from conventional equity funds to Shariah-compliant investments. Investors can tailor their portfolios according to their financial goals and risk tolerance. By understanding the landscape of mutual funds in Pakistan, including the best options available, profit rates, and effective investment strategies, individuals can make informed decisions that align with their financial aspirations.

To make informed investment decisions in mutual funds, it is essential to conduct thorough research, assess the mutual funds’ profit rates in Pakistan, and select funds that align with your financial objectives. Understanding the fundamentals of mutual fund investing, choosing reputable fund managers, and regularly monitoring your investments will optimize your portfolio’s growth.

Overall, mutual funds are gaining traction in Pakistan, providing both conventional and Islamic investors with a structured pathway to wealth accumulation. With proper management and an informed approach, this market can offer security for individuals’ financial futures.

So, whether you’re exploring the best mutual funds in Pakistan or examining profit rates, remember: knowledge is your greatest asset. To conclude, “Learn, know, and invest!”